Contents:

Inferring morning start pattern will require some more understanding. The small gap on day 2 can be bearish, bullish or neutral. A neutral gap forms a morning Doji star, which is a variation of the morning star that represents indecision in the market. However, it is day 3 that holds the most importance and signals true development. In summary, the Morning Star Candlestick pattern is a powerful bullish reversal pattern that is formed by three consecutive candles. The pattern indicates that the bears are losing control, and the bulls are starting to take over.

https://1investing.in/ in the stock market and in other securities entails varying degrees of risk, and can result in loss of capital. Readers seeking to engage in trading and/or investing should seek out extensive education on the topic and help of professionals. Small candlesticks indicate that neither bulls nor bears could move the trading and prices finished about where they started.

What is a Morning Star Candlestick Pattern?

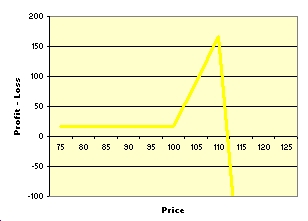

The ‘V’ pattern of this candlestick pattern is easy to interpret. The market has been in a steady downturn, but it hits its lowest point and begins the long climb back upward. Clearly, sellers are losing strength while the buyers are rallying. Because of this, the morning star pattern is considered a strong indicator of a bullish reversal in the future. The Morning Star candlestick pattern is a bullish reversal indicator that has historically been an accurate predictor of market reversals. Traders use the morning star candlestick pattern to signal that the market may be reversing, particularly after a long downtrend, since the morning star candlestick is an indicator of strength.

The star is a representation of weakness identifying that sellers were not able to achieve a price lower than the close during the previous period. This weakness is confirmed by the candlestick that follows the star. This candlestick must be a dark or red candlestick that closes well into the body of the first candlestick. Today we are going to tell you about the most important things in trading, candlesticks! 📌Japanese candlestick charts were developed in the 17th-18th centuries by the Japanese rice traders.

Harami Candlestick Patterns: Complete Overview, Types, Trade Setups

The second candle is a small real body that gaps lower than the first candle’s body. The third bullish candle’s body sometimes gaps higher than the second one but does not happen often. Nifty chart showing bearish engulfing candles and a trend reversal post, formation of the requisite pattern. Similar to many others, the candlestick pattern is a visual pattern. In many cases, the pattern is giving a successful forecast of an upcoming trend. But in many other cases, the pattern fails to give successful results.

Is a doji star bullish or bearish?

A gravestone doji candle is a pattern that technical stock traders use as a signal that a stock price may soon undergo a bearish reversal.

The Evening Star is similar to the Morning Star, except it is a bearish pattern. The evening star appears at the upper end of a bullish trend. Like the Morning Star, the Evening Star is a three-candle pattern and develops over three trading sessions. The morning star pattern reversal completes in three trading sessions overall . The second candlestick is the star, which is a candlestick with a short real body that does not touch the real body of the preceding candlestick. The gap between the real bodies of the two candlesticks is what makes a Doji or a spinning top a star.

How to Trade using Morning Star Candlestick Pattern?

The long black candle during the downtrend visually reflects that the bears are in command. A change is seen in the advent of the star, which signals an environment in which the bulls and the bears are more in equilibrium. This is not a favorable scenario for a continuation of the bear market. Be sure you practice identifying and trading these candlestick patterns on a demo account before trading them with real money.

Traders use the candlesticks to forecast the short-term direction of the price, via the different candle stick patterns formed. There must be a large red candle showing bears are expecting more downward price movement. At such moments, traders are thinking of further lower prices and therefore selling more. Traders are looking to short more because there’s no price reversal signal on the horizon.

Combining Technical and Fundamental Analysis

The normal practice is to take positions at the end of the third day or at the beginning of the fourth day. A Morning Star candlestick can indicate a reversal in a stock or future’s price trend. There are over 100 candlestick patterns, hammer, dark cloud cover, doji, morning star, evening star, harami are only a few of the recognised candlestick patterns.

Mill District Velo Cultivates Community Through Spring Cycling Events – Benzinga

Mill District Velo Cultivates Community Through Spring Cycling Events.

Posted: Thu, 02 Mar 2023 14:00:00 GMT [source]

The third morning doji star candlestick pattern must not engulf the second candle and must leave it isolated. The star does not need to form below the low of the first candlestick and can exist within the lower shadow of that candlestick. According to technical experts, the price accurately reflects all available information about the stock, meaning that it is efficient. However – past price performance does not guarantee future price performance, and a stock’s present price may have little to do with its true or intrinsic worth. As a result, technical analysts employ methods to sift through the noise and identify the greatest wagers.

Best Analysis

The type of doji, in my opinion, is not particularly significant in this instance; this point will become clearer as we explore the psychology underlying the formation. The stoploss for this trade will be the highest level of P1, P2, and P3. P2 should give a gap-up opening and form a doji or a spinning top. With the gap-down opening, P2 should be either a doji or a spinning top. The gap-down opening is shown with the green arrow in the picture below.

- An Evening Star that has a doji instead of a small real body as the second candle is called an evening doji star.

- So, for a daily chart, one candlestick represents the activity of a single day.

- In addition to the disclaimer below, please note, this article is not intended to provide investing or trading advice.

- But they should also be grouped with other technical indicators.

A variety of candle stick patterns visible on BankNifty chart on Quantsapp. Doji convey a sense of indecision, hence it requires confirmation from the next candlestick. A doji with an equal open and close would be considered more robust.

The evening star is the pattern that stands in opposition to the morning star and denotes the transition from an uptrend to a downturn. A valid morning star candlestick pattern with prices closing above the pattern has a 93% chance of causing the price to move higher. A downtrend attempting to recover with a small pullback earlier creates a support level, which is followed by the formation of a morning doji star and prices reverse from bearish to bullish trend. Unlike the one and two candlestick patterns, both risk-takers and risk-averse traders can initiate their trades only on P3. While trading based on the Morning Star pattern, it is not necessary to wait for the confirmation of the pattern on Day 4.

It is important to understand that traders have dissimilar perceptions of a downtrend. Some traders consider that lower highs and lower lows ideally illustrate downtrends. Others look for a short streak of lower candlesticks placed consecutively. Differences also exist in gaps between the three candlesticks. The star candle in this pattern may not be below the low point of the darker candlestick and may exist within its lower shadow as well.

When a pattern appears in an ongoing uptrend, there are opportunities during pullbacks, and it is also one of my favorite trading methods. The currency pair EUR/USD is used to illustrate the candlestick formation in the example above, which shows the pattern’s most frequent occurrence. The stoploss for a long trade is the lowest level of the pattern.

How reliable is morning star candlestick?

Morning star patterns are generally seen as reasonably reliable indicators of market moves. They're comparatively easy to spot, too, making them a useful early candlestick pattern for beginner technical traders.

What does a morning doji star mean?

A Japanese candlestick bullish reversal pattern formed during a downtrend. It consists of three candles. The first is a long black body formed in the direction of the downtrend. The second is a Doji that gaps lower signaling indecision and also the weakness of the sellers.