Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Sometimes that flexibility can be a disadvantage, depending on the investor. There are many assets to choose from when building an investment portfolio. cash and carry model Until recently, most ETFs were not available as fractional shares (depending on your brokerage, they still might not be). Index funds, on the other hand, have always been available in fractional amounts. While some index fund providers have lower minimums if you set up regular contributions to a tax-advantaged retirement account, they can still be substantial.

- If it sounds a lot like an index-tracking ETF and an index-tracking mutual fund are pretty similar, don’t worry; that’s because they are.

- The number of stocks I own varies based on market conditions.

- Morningstar looked at the average expense ratios of actively managed equity mutual funds versus index equity funds and index equity ETFs.

- In the end it comes down to a matter of preference, how sensitive you are to fees, and what options are available at your brokerage of choice.

“For example, a young investor saving for retirement has a long time horizon and can afford to take risks which a retiree should not,” Crowell says. Fund managers may use a representative mix of the index for larger indexes, which can have thousands of different securities. Fund managers may be able to mirror the Wilshire 5000 index with just 500 stocks instead of all 3,000-plus in the index, says JB Beckett, founder of Beckett Financial Group. The most popular ETFs trade with more liquidity than most stocks, meaning there are always plenty of buyers and sellers keeping the bid-ask spreads low. If the price is at a premium to the NAV, it’s better to wait or simply buy any other ETF tracking the same index.

Index fund vs. ETF

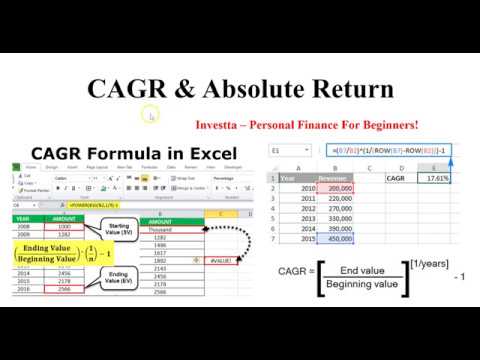

Since June 1999 to Feb 2021, the Nifty 50 Index has seen returns of 13.5 % p.a. You won’t get that number every year—some years it’ll be higher; some years it’ll be lower—but on average, it’s enough to double your money every 7.2 years or so. When you’re investing, one thing to consider is diversification — basically, owning a mix of investments within and across asset classes. A truly passive https://1investing.in/ investor purchases an index and then “sets it and forgets it.” Trades would only take place when the index’s composition is changed as companies are added or dropped by the index provider. Easily research, trade and manage your investments online all conveniently on Chase.com and on the Chase Mobile app®. Morgan online investing is the easy, smart and low-cost way to invest online.

Most of the time, all it takes to invest in an ETF is the amount needed to buy a single share, and some brokers even offer fractional shares. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances.

Decide how to buy your index funds

That’s different from index mutual funds because you sell these shares to a fund manager. If the fund manager then sells the underlying assets for a gain, those gains are spread among every investor who owns shares in the fund. Index funds, on the other hand, must buy and sell assets to adjust their portfolio to track the underlying index. The cost of any capital gains taxes from these sales are taken out of the fund portfolio NAV, which impacts the value of your index fund shares.

For example, I’m more likely to buy stocks in an investment climate where more opportunities exist. At the beginning of the COVID-19 pandemic, the stock market experienced a sharp drop. Knowing I could buy stocks at a fraction of the price they were previously trading at gave me a desire to hunt for good opportunities. Wondering whether exchange-traded funds, also known as ETFs, or index funds are a better investment for you?

Index funds and ETFs can be a fundamental part of building a successful portfolio. What you need to know

The biggest difference is that ETFs can be bought and sold on the stock exchange (just like individual stocks)—and index funds cannot. Another benefit of ETFs is that—because they can be traded like stocks—it is possible to invest in ETFs with a basic brokerage account. There is no need to create a special account, and they can be purchased in small batches without special documentation or rollover costs. Investment research firms report that few (if any) active funds perform better than passive funds over the long term. The more stocks I add to my portfolio, the more I need in investable assets. Researching and picking enough stocks to ensure proper diversification can be time-consuming.

BNP Paribas AM strengthens Swiss ETF sales team with Credit … – ETF Stream

BNP Paribas AM strengthens Swiss ETF sales team with Credit ….

Posted: Wed, 13 Sep 2023 13:48:37 GMT [source]

They can be bought and sold on an open exchange, just like regular stocks, as opposed to mutual funds, which are only priced at the end of the day. It states that over 80% of actively managed funds under-performed the S&P 500. This suggests that, when investors try to be clever and invest in such a way that they beat the growth of the stock market, eight out of ten times, they fail to do so. This individual shares many of the goals of the truly passive investor, but may exhibit greater sophistication and want to effect changes in their portfolio with greater speed and precision. For this type of investor, the ETF would be more appropriate.

What is the difference between an index fund and an ETF?

Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. When you open a new, eligible Fidelity account with $50 or more. Investing in an index fund is like taking the train when you travel. Other methods might get you to your destination faster but might cost more or require more effort.

In doing so, you take advantage of low fees and diversification, and an investment that will grow over time. If you buy and sell frequently, ETFs are the clear winner when it comes to taxes. When shares of an ETF are sold, only the seller pays capital gains taxes. However, index mutual funds can come with hefty trading commissions and may also have load fees, which are a form of sales commission.

NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. If you haven’t begun your investment journey yet, now is the perfect time to get started with ET Money. By choosing ET Money, you can invest in mutual funds without any commission charges and conveniently track all your investments in a single place. You’ll also receive a comprehensive portfolio health check-up absolutely free of cost.

However, this expense is usually very small if you’re buying high-volume, broad market ETFs. Both ETFs and index funds can be very cheap to own from an expense ratio perspective — you can easily find funds that cost less than 0.05% of your investment per year. But for index funds, brokers often put minimums in place that might be quite a bit higher than a typical share price. If you have only a small amount to invest, consider an ETF with a share price you can afford or an index fund that has no minimum investment amount. Once you know the index or indexes you want to track, you need to choose your funds. If you opt for passive management, you generally want to choose the least expensive fund that performs similarly to its underlying index.

SEBI has instructed fund houses to publish iNAV or intraday NAV for ETFs. This iNAV can tell you what the actual worth of one unit of an ETF is. If the price is higher, you are actually paying more than what the ETF is worth. If all schemes track an index, their returns should be similar.

If the fund behaves just like the index, the tracking error will be low. If a scheme is not doing a good job, the tracking error will be high. So, it’s nearly impossible to compare them all, and hence for our analysis, we will focus on the index funds and ETFs based on the Nifty 50. ETFs and index funds track an underlying index, so they are similar here. Alright, let’s start with a quick recap of the differences between ETFs and index funds. So even if you know the nuances of investing in ETFs and index funds, the in-depth analysis in this article will still give you some useful insights.

How to Invest in ETFs: Learn How ETF Investment Works in 2023 – MoneyWise

How to Invest in ETFs: Learn How ETF Investment Works in 2023.

Posted: Tue, 22 Aug 2023 01:07:49 GMT [source]

The Investment Company Institute’s latest survey of expense ratios looked at the average expense ratios of actively managed equity mutual funds versus index equity funds and index equity ETFs. As mentioned previously in this article, an index fund that must constantly rebalance to match the tracked index generates taxable capital gains for shareholders. The structure of an ETF minimizes taxes by trading baskets of assets, which protects the investor from exposure to capital gains on any individual security in the underlying structure. You’ll typically pay more for this added level of manager supervision.